How do you measure Success?

I can confidently say that it is everyone dream to be successfully in life. From the time when we learn how to walk till the day we retire, success is bound to be in every corner of our lifes. But how do we actually measure success?

So I decided to conduct a small little survey with several close friends of mine.

Here is the question thrown to at my respondents, In your own opinion, How do you measure success?

First respondent(my ex-sifu)

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

measure by the goals u set lah

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

like this yr

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

wat u set the goals

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

then compare how much u achieve

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

then u need benchmarking also

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

like who is ur idol

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

u compare ur success with his

- F à c é B ö ö k ë d [ O n M C ] says (02:36 AM):

then u knw where u stand

My second respondent:

*sara. says (02:41 AM):

happiness and completion of goals

Third respondent:

BoNG says (02:50 AM):

it's a journey, not destination. Measure by daily, hourly or evan every minute of what are are doing.

BoNG says (02:50 AM):

i believe successful ppl plan their goals at least daily.

Fourth respondent:

Rchel says (03:00 AM):

success is when u have achieved what u want in life and is happy with what u have and are

So how do you measure success? do share your opinion by dropping your comments. Thanks.

Now you can buy the World. Can you afford it ?

How many times have you ever think and say to yourself I could run this country better if i was given the chance? I would like to own and run Malaysia, Australia or maybe the UK? It may seems impossible and people around you may also think that you are insane, Hitler wannabe, and maybe day dreaming.

Modern Technology and Globalisation finally made it possible for you to own any country of your choice, provided you have enough legal tender notes to burn.

Ladies and Gentleman, without further ado, I would like to present to you "THE WORLD". Yes you heard it right, THE WORLD. So what is the world? The World is the latest property development conceptualise by H.H General Sheikh Mohammed Bin Rashid Al Maktoum, Crown of Dubai. So what is THE WORLD? Well its a development project which rebuild the world, but in a smaller scale, a total of 300 island will be build to resemble countries and continents, and the final product will resemble the world map.

Claimed to be the world's most innovative real estate development, every single country and island will be put on sale. So if you have the tough of buying Australia and turning the whole country into a resort with Asian theme, its entirely up to you as long as you have the financial baking to do so.

The World, comes with 4 pre-planned Island Typology, namely Low Density, High Density, Resort and Commercial. It also comes with hubs and transportation service such as water taxi. now how is that for a change, traffic jam at sea.. The World also comes with complete with a high tech water, power and sewage system.

With this new development, you can travel THE WORLD in less than a day. Now that's globalisation.

Welcome to the rich man's world. Wish I could afford to buy the cheapest Island though.

So would you buy a piece of property at THE WORLD if you had the money? and which country would you like to buy ?

To find out more kindly click Google Result or YouTube

Who is Charlie Chia?

Well, just to make life simple, and to avoid such stupid and common questions being asked over and over again, please take your time to read the biodata below.

Name: Charlie Chia

Date of birth: Age is mention above. So do your own maths. If you problem reading this, kindly contact me, I will be more than happy to sponsor you the cost of a specialist check up.

Address: Due to the threat of terrorism. This information shall be classified as confidential.

Mobile: Sorry its only for my close friends and business associates

Email: charlie.chia@gmail.com (Enquiries, Sponsors, Career Opportunity, Business Development)

Nationality: A proud Malaysian

Passion:

AIESEC, Wealth Creation and Preservation, Business Development, Marketing.

My Favourites:

Food: Roti Telur, Roti Banjir, Roti Telur Bawang, Roti Bom, Maggie Goreng, Char Kuey Teow, Chee Cheong Fun.(Eat these 6 times a day, who says malaysian only eat 5 times?)

Drink: H2O(Free most of the time), Shuit Cha(Chinese Tea with Ais, cost RM0.40), Ais Kosong(Chilled H20, cost RM0.20)

Clothes: Padini, Pasar Malam Apparel(SS2 and Petaling Street),

Why did you want to become a millionaire?

I wanted to be a billionaire. Being a millionaire is just the beginning I guess, but I am happy with what I have now.

Wait, you still did not answer the question, why did you want to be a millionaire or billionaire?

Sense of Security, It true that money cant buy happiness, but you will certainly be more miserable with out money.

How does it feel to be a millionaire?

Answer: Life still goes on. I still eat, drink and wear everything mention at my favourite column.

Who is your role model?

Tan Sri Lim Goh Tong, for his ability to dream the impossible and turn it into reality.

Lee Kah Shing, turning waste into dollars

Dato' Tony Fernandes, the guy who revolutionise air travel and making it affordable for you and me.

Being Wealthy isn't just a dream.

U-Turn, What a scary invention?

Ive not done either of it since I started driving, but I would have been in big trouble if I was stop last week. Last week I went for a gathering with some of my ex-college(Mantissa) friends, namely Juliet, Tim, Colin and Soon Lee at Mc Donalds, Center Point. I was suppose to give Soon Lee and Colin a ride home after the gathering as they were both living at TTDI. Driving out of McD, the fastest way back to TTDI make a U turn right before the former Sony HQ traffic light. While driving I saw a police road block being setup on the opposite direction thus I decided not to make a U-Turn but drive to TTDI via Damansara Utama. That was on the 20th September. Today I'm glad I made to choice not to make that U-Turn. Why ? Cause while having lunch at Equatoria Kuala Lumpur yesterday, my mum reminded me to renew my driving license, which upon checking I realised that my license has expired on the 14th of September 2007.

Shit man, thinking back, I'm so glad I have not made the U-Turn or else the chances of me getting stopped and brought to the police station will be fairly high. Today, 24th, monday, I woke up early in the morning and rush to the nearest Pos Office to renew my driving license to avoid being end up with any legal actions. Guess what, the renewal for 1 year cost me RM32.

50 minutes pain in the ass.

Charlie, Andrew, Wong Hon, Marco, Kevin, Alan

Another Heng Tai leaving......

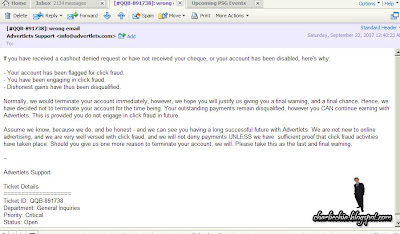

Got a warning from Josh Lim. Who is he ?

For those who are curious, let me tell you, you can save the trouble. Here is 2 snap shot which you might find interesting.

Election is Coming, What's do you have to say?

Yes, it has been the talk of the town for months and been widely speculated by the public that the election will be call this year. Why are there such speculation in the first place? Well for a young chap like me, I may not have a complete understanding on the whole election system, the process as well as the pros and cons.

Anyway, from my analysis, the widely speculated election was base on the robust economic growth this year and having launch several Multibillion dollar project such as the Southen Corridor Economic Region(SJER), the Northen Corridor Economic Region(NCER) and the Eastern Corridor Economic Region(ECER) willl be be launch by year end. Apart from this, the local equity market(a.k.a stock market) as been hitting new high since the 1997 Asian Economic Crisis. Investors confidences are said to be at its peak now since the crisis which struck Asia a decade ago.

From the political view point, the Opossition party has been having trouble retaining its talent, with some of its top leader leaving the Opposition party(well it is not know if they leave to join the BN). It is also widely speculated that our Prime Minister, Pak Lah will be calling for an early election by this year because our Ex-deputy Prime Minister Anwar Ibrahim has been barred from court to run for office until March 2008. So having an election will prevent him from campaiging for a parliment seat.

Anyway, for the man on the streers who invests in the local stock market or even property would welcome an early election, mainly because it will trigger an mini bullrun and spur higher economy growth should the currently government with another 5 years mandate (which has always been the case since Merdeka). However the % of winning will determine how policies will be shape for the next 5 years. On the negative side, there is always be some side effect. For some, an election spells disaster. Why is that so? Cause generally, after election, prices of goods and services will be hike up, thus essential items like Petrol, Toll, Electric, Water, will be hike up translating to higher cost and inflation to poor folks like me and you, and also contirbuting to the rising Consumer Price Index(CPI).

So my guestion is, do you think we should have an early election? and Why?

69% Hopeless

[x] Gotten detention.

[ ] Gotten your phone taken away

[ ] Gotten suspended

[x] Chewed gum during class.

Total: 1

[x] Been late to a class(s)more then 10 times

[x] Didn't do homework over 5 times.

[ ] turned at least 3 projects in late.

[x] Missed school cause you felt like it

[x] Skipped class at least 3 times.

[ ] laughed/talk so hard/loud you got kicked out of class

Total so far: 5

[x] Got your mom/dad etc. to pick you up from school

[x] Text people during school

[x] Passed notes.

[x] Threw stuff across the room.

[x] Laughed at the teacher

Total so far: 10

[ ] Went on myspace, friendster, xanga, etc. on the computer at school, chat rooms..

[x] Took pictures during school hours.

[x] Called someone during school hours.

[x] Listened to an ipod/cd player/mp3 during school

Total so far: 13

[ ] Threw something at the teacher

[x] Went outside the classroom without permission.

[x] Broke the dress code.

[x] Failed a class test

[x] Ate food during class.

Total so far: 17

[ ] Gotten a call home

[ ] Couldn't go on a field trip cause you behaved badly

[x] Didn't take your stuff to school

[x] stuck your middle finger at a teacher

[x] cursed during class loud enough so the teacher could hear

Total so far: 20

[x] slept in class

[ ] threw paper at the teacher

[x] copied homework

[ ] felt hungry during class and left to eat

[ ] snored in class

[x] talked back to a teacher

TOTAL: 23

3x your total = 23 x 3 = 69%

It's a lesson worth considering....

Personally, I think this article is good and you guys should read it, though some of the information might have become irrelevant as time has pass. But its good knowledge and I'm sure you could use it one day when you have kids of your own or some who already have.

------------------------------------------------------------------------------------------------

The Automatic Millionaire by David Bach

Five Gifts That Teach Kids About Money

by David Bach

Tuesday, December 19, 2006

A few weeks ago, my wife, Michelle, and I were invited to our son Jack's pre-kindergarten class to teach an art project. Jack is three, and the thought of teaching an art project to a roomful of three-year-olds was both exciting and daunting. What would we teach? Would it be fun -- and could we actually come up with a project that would keep their attention?

The Plunk Factor

We arrived at Jack's classroom several days later -- armed with paint, glue, stickers, sparkles, and a white ceramic piggybank for each child. The kids were bubbling with excitement as we got started. We shared with them what a piggybank is used for as they worked diligently -- as only three-year-olds can -- at decorating their own personal pig. We continued with our money lesson. Coin by coin, we instructed, "This is a penny, a nickel, a dime, a quarter..." At three years of age, most of the kids understood that a paper dollar was the "most money," but some were happier with the "plunk factor" of the coins. Some of the kids didn't want to put the coins in the piggybank. Instead, they wanted to put them in their pocket. One little boy started to cry when the coins went into his piggybank and he couldn't get them out. (I suppose he won't be much of a saver!) We wrapped up our lesson by explaining the power of putting money in the piggybank now to save for a toy later.

A Gift Bonanza

Such a simple lesson, yet it made as much of an impact on the kids as Michelle and I had hoped. And it also got me thinking: During the holidays, what gifts can we give to the children we love that will teach them about money and get them on the right track at an early age? So here are my five favorite money-teaching gifts for children this holiday season (and, truth be told, these are appropriate anytime -- not just at the holidays):

1. Piggybanks (ages 3-11)

The piggybanks we bought for my son's class cost about a dollar each. They're plain white -- perfect for decorating and can be ordered online. Use them to teach your kids about the value of money -- what it's worth, why you save, and how to save -- and have some creative fun in the process. For something a little different, check out Moonjar's moneybox. Made up of three compartments, the moneybox inspires spending, saving and sharing. Another favorite is the Money Savvy Pig. This bank has four different chambers -- one each for spending, saving, donating, and investing. It comes in a variety of shapes and sizes. My last piggybank recommendation is one I actually bought for Jack for the holidays. It's called the LeapFrog Super Saver Teaching Bank. This bank tells you what each coin deposit is worth and then gives you a bank balance. I know Jack's going to love it.

2. Storybooks about money (ages 3-8)

Books make such wonderful gifts, and there are so many amazing titles to choose from. Browse your favorite bookstore or shop online. Some of my favorite money storybooks for young children include "If You Made a Million" by David M. Schwartz, "Alexander, Who Used to be Rich Last Sunday" by Judith Viorst, "A Dollar for Penny" by Julie Glass and "It's a Habit, Sammy Rabbit!" by Sam Renick. Read these aloud to your child -- or, if they're old enough, let them read them to you. Kids will enjoy the stories for what they are, and learn something in the process.

3. Monopoly (ages 8 and up)

This classic board game has sold over 200 million copies worldwide over the past 72 years. This was my favorite game growing up -- are you surprised? It can change your life when it comes to money, because you can actually learn lessons from playing it. The most obvious lesson it teaches is that you can't get rich renting. If you don't own property when you play Monopoly, you lose. Renting makes the player who owns the property rich and, ultimately, the player who doesn't own property poor. A lot like real life. Other real-life lessons that Monopoly players learn is that it's easier to get rich and win the game by buying less-expensive properties first, because you can build faster and then use the cash flow from these properties to buy the higher-end properties. There are countless editions of Monopoly available now, which makes it even more fun.

4. Beginning Personal Finance Organizer (ages 13-19)

If you've read any of my books, you already know how I feel about the importance of organization. The Cash Cache, as this product is called, is a great way for teens to organize their financial lives. This nifty organizer contains a 36-page handbook for beginners that covers the basics of personal finance. It also includes templates for setting goals and tracking progress; four pouches to organize cash for saving, spending, donating, and investing; handy pockets for financial documents; and even a small padlock for privacy. This is a great gift for any high school student.

5. Stock (all ages)

Last year, I wrote a column about how my Grandma Bach taught me my first lesson in investing when she helped me become a stockholder in my favorite childhood restaurant -- McDonalds.

Teach your child how to "own the place" by opening up a custodial investment account in his or her name. Let your child select companies they have an interest in -- like McDonalds, Nintendo, Disney, and so on -- and with your guidance they can invest in and become owners of these companies.

Teach them how to track their stock performance on a regular basis to watch their investment grow. Two online services that make setting up a custodial investment account easy and affordable are Sharebuilder and MyStockFund Kids. Both sites allow you to open an account online in minutes. Sharebuilder requires no minimum investment, while MyStockFund Kids requires only $10 to get started. Review the different types of plans they offer so you can pick a pricing plan that works for you. Another neat way to purchase stock as a gift is through OneShare.com. The actual stock certificate from the company you choose comes beautifully framed and engraved for your little shareholder. When I was small, my parents gave me a share of Disney stock in a gold frame -- I still have it to this day!

Lessons for a Lifetime

Remember, it's not just the gifts that teach, it's the lessons behind them. Enjoy the holidays with the kids you love -- and here's wishing you all a prosperous new year!

The Automatic Millionaire is the registered trademark of David Bach and FinishRich Media, LLC. The columns, articles, message board posts and any other features provided on Yahoo! Finance are provided for personal finance and investment information and are not to be construed as investment advice. Under no circumstances does the information in this content represent a recommendation to buy, sell or hold any security. The views and opinions expressed in an article or column are the author’s own and not necessarily those of Yahoo! and there is no implied endorsement by Yahoo! of any advice or trading strategy.

------------------------------------------------------------------------------------------------

What's the value of friendship?

Friends, they are the people who will standby us regardless of race, gender, believed, age, social status, and financial condition. At least that what I believed in. Throughout out my life, since i begun my childhood education till I completed University till I worked, my life has not always been a bed of roses. My life is like a roller coaster, fill with up and down. However I consider myself pretty lucky as I have always come across friends that I can count on at every stage of my life cycle.

I place great importance in friendship and I'm also the one who always initiate a gathering or a meet up, basically I because I view friendship as the most valuable things in life that money cant buy besides my family and health.

Though these days I've indulge most of my interest in career development and wealth creation, I will always have time to be spend with my friends. If you would like to know how I value you as my friends, maybe the illustration below would help.

-Mango Passion Fruit(Frappuccino Blended Drink) = RM13.13

Starbucks

-Curry Udon at Sushi Groove = RM15.90

-10 board lot of HELP International Corp. (14/09/2007) = RM1240

-1 board lot of Digi Telecommunication (14/09/2007) = RM1940

-My Asus Notebook W3(which i bought 2 years ago) = RM4500

-My Nissan (my favourite red mobile) = RM4600

-Value of friendship = PRICELESS

To all my friends out there who is reading this, regardless of gender, race, and faith, no matter how long we know each other, no matter how far we are apart now, I will always always always cherish all the moments we have together, simply because you are one of my most valuable assets in life. So no matter where you are, what you are doing or how long we have been apart, do keep in touch with me and keep my updated, or else i shall hunt you down personally. Wuahahaha....

So remember, keep in touch, either via MSN, SMS, SKYPE, House Phone, Mobile Phone, friendster, this blog or just hunt me down also lah......

To the following people on my wanted list, kindly take note that you are currently being hunted by Charlie, and he has a message for you: You can run but you cant hide.

RM100,000 up for grab !!!!

Well if any of you guys has been reading The Edge Financial Daily which you can easily get yourself a copy from the local newsstand for RM1.50 per issue daily, you would have notice a full page advertisement with red and white template. Which is very similar to the AirAsia or even Genting 888 deal advertisement.

Called BURSA PURSUIT, this is the latest advertising and promotion project launch by Bursa Malaysia(The Malaysia Stock Exchange Inc) in its quest to create awareness and to educate the Malaysian youth between the age of 20 to 35. This is a online simulation which gives every eligible participant who sign up with a start up capital of RM250,000 virtual cash to be invested into the simulation which will mimic the local stock market movement in term of share prices, as well as both supply and demand for all listed securities(basically stock of companies lah). The contest which will be schedule to start of 1st Oct 2007 will run for a span of 2 months until 30th Nov 2007. After which participants will be judge according to their total wealth(or in some case loses) accumulated from the initial start up capital given.

There will be 3 categories, Individual(for beginner like you and me), Professional(Individual licensed by Bursa Malaysia) and League(where you and your friends could create a league with a minimum of 5 people). There will be 3 prizes for each category:

1st - RM 100,000

2nd - RM 30,000

3rd - RM 20,000

Besides that, there will also be 5 consolation prizes of RM2,000 each for the 5 best performing investors(participants).

So what are you waiting for, go sign up now at http://www.bursapursuit.com/.